NAME OF GOODS HEADING CHAPTER EXEMPTED 5 10. The new Sales tax will be levied on taxable goods that are imported into or manufactured in Malaysia.

Russia Imports From Malaysia 2022 Data 2023 Forecast 1996 2020 Historical

Please complete information below.

. Duty rates in Malaysia vary from 0 to 50 with an average duty rate of 574. Sales Tax Rates of Tax Order 2018. Budget 2019 Indirect Tax Updates On 2 November.

What To Expect If Your Buyandship Shipment Gets Taxed By Kastam Buyandship Malaysia The arizona use tax is a special excise tax. The amount of duty payable is based on the goods value and the product type. Accordingly any services rendered whether in whole or in part before 1 June 2018 are still subject to 6 GST.

Goods are taxable unless they are specifically listed on the sales tax exemption list. New principal hub companies will enjoy a reduced corporate tax rate of 0 5 or 10 rather than the standard corporate tax rate of 24 for a period of five years with a possible extension for another five years. Malaysia Import Duty Calculator.

GST is charged at standard rate of 0 on the part of work performed until 31 August 2018. Reduction of import duty rate on bicycles. Corporate companies are taxed at the rate of 24.

Year Assessment 2017 - 2018. For example if the declared value of your items is 500 MYR in order for the recipient to receive a package an additional amount of 5000 MYR in taxes will be required to be paid to the destination countries government. The SST is also applied to the importation of taxable goods into Malaysia at the rate of 5 or 10 percent or a specific rate depending on the category of products.

Subject to an importexport license from the relevant authorities This Guide merely serves as information. The MOF announced on July 16 2018 that the Sales and Services Taxation SST is chargeable on the manufacture of taxable goods in Malaysia. The proposed sales tax will be 5 and 10 or a specific rate for petroleum.

Headquarters of Inland Revenue Board Of Malaysia. Effective from 1 January 2019 import duty rate is proposed to reduce from 25 to 15 on such bicycles. GST is charged at standard rate of 0 on the part of work performed until 31 August 2018.

Import duty is a tax levied on imported goods at the point of entry into Malaysia. Assessment Year 2018-2019 Chargeable Income. Malaysia Import Tax Rate 2018.

Some goods are not subject to duty eg. Page 2 of 130. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil.

Please refer to Sales Tax Goods Exempted From Tax Order 2018 and. Please refer to Sales Tax Goods Exempted From Tax Order 2018 and Sales Tax Rates of Tax Order 2018. The Ministry of Finance announced on July 16 2018 the SST is chargeable on the manufacture of taxable goods in Malaysia and the importation of taxable goods into Malaysia at the rate of 5.

On the First 5000 Next 15000. The Tax Free Threshold Is 500 MYR If the full value of your items is over 500 MYR the import tax on a shipment will be 10. Similarly any goods supplied before 1 June 2018 are still.

Laptops electric guitars and other electronic products. Sales Tax Imports are subject to GST at a standard rate of 6 of the sum of the CIF value duty and any excise if applicable. In Budget 2017 it is suggested that decrease of expense rate for increment in chargeable wage will apply for YA.

Importing to which country. For Year of Assessment 2018 the rates for lower brackets earners have been decreased from 5 to 3 10 to 8 and 16 to 14 for the year of assessment 2018. Malaysia Import Tax Rate 2018.

Exporting from which country. On the First 5000. Meanwhile the balance of the work completed on 15 October 2018 shall be charged with Sales.

General Guide On Sales Tax - Ver 4 As at 19 January 2019. Tax Rate of Company. Rate TaxRM A.

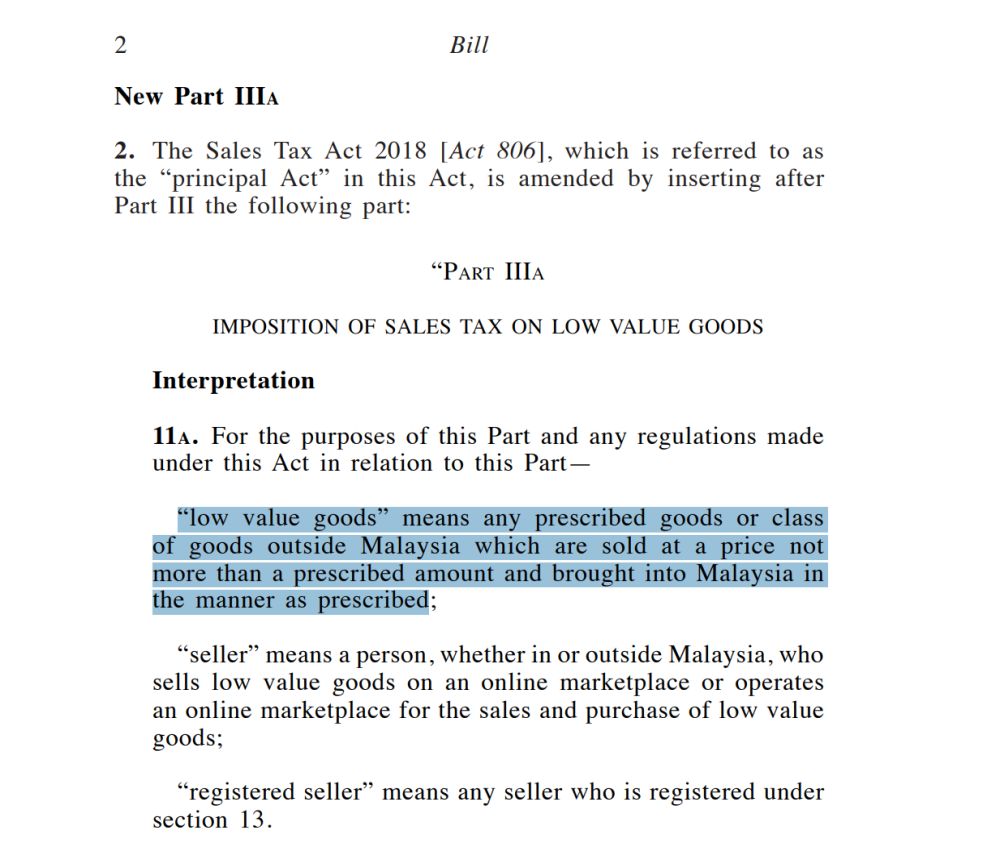

What is the HS Code of your Product. Sales Tax Act 2018 applies throughout Malaysia excluding the Designated Areas and the.

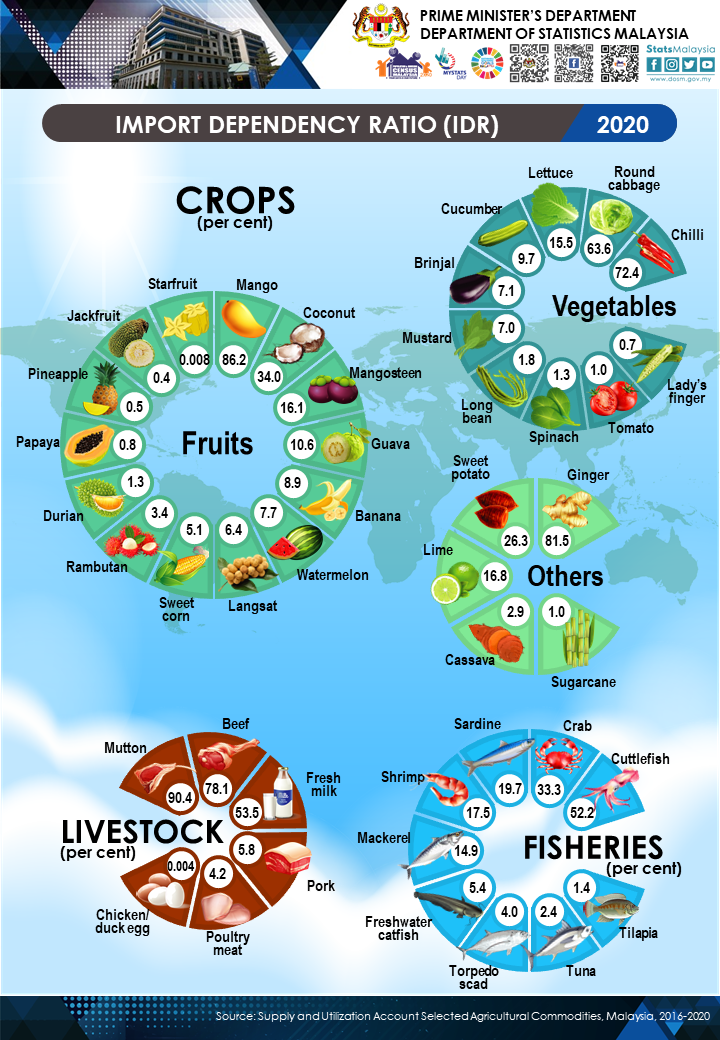

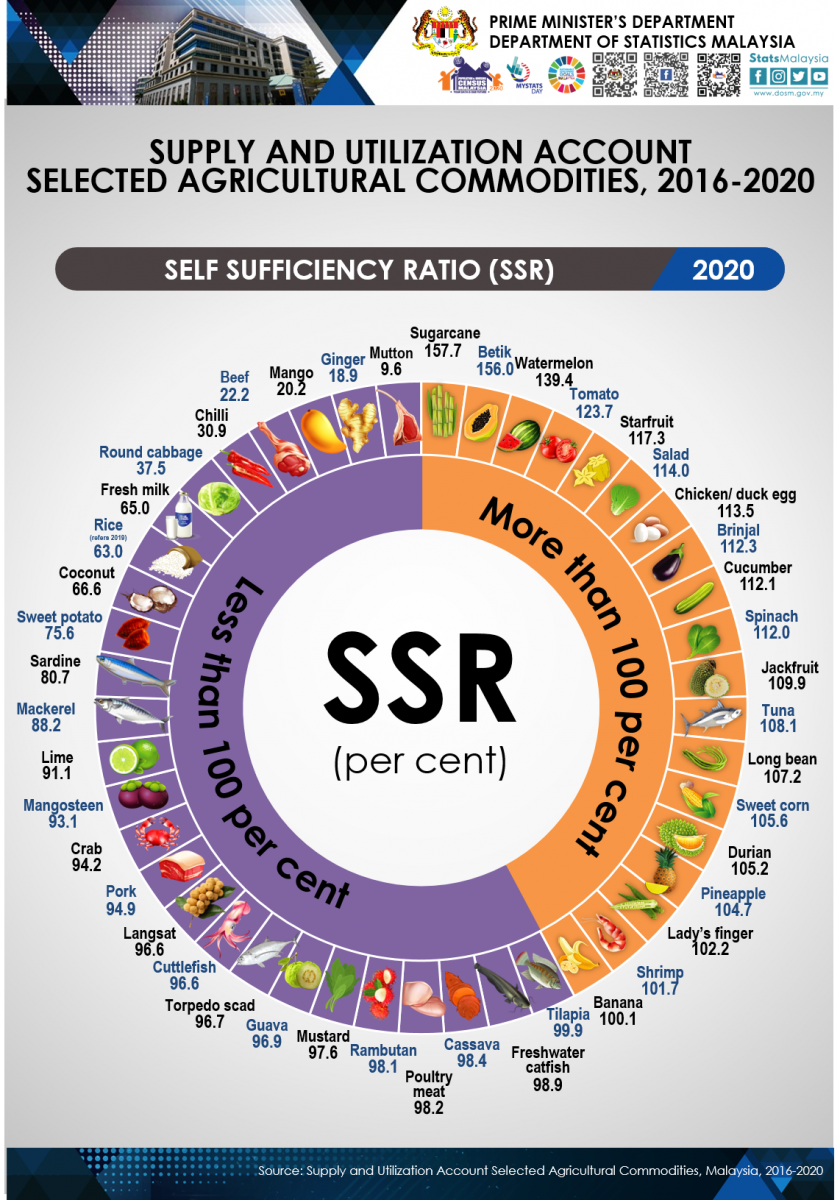

Department Of Statistics Malaysia Official Portal

Online Shopping Tax Malaysia Is A Step Closer To Impose 10 Tax On Imported Goods Worth Under Rm500 Soyacincau

International Shipping To Malaysia A Guide For Ecommerce Merchants Janio

Malaysia Exports To Russia 2022 Data 2023 Forecast 2015 2021 Historical

Online Shopping Tax Malaysia Is A Step Closer To Impose 10 Tax On Imported Goods Worth Under Rm500 Soyacincau

United States Imports From Malaysia 2022 Data 2023 Forecast 1991 2021 Historical

Malaysia Total Revenue From Sin Tax On Cigarettes And Tobacco Products 2018 Statista

Malaysia Imports From China 2022 Data 2023 Forecast 2015 2021 Historical

Malaysia Macroeconomic Country Outlook Globaldata

/cloudfront-us-east-2.images.arcpublishing.com/reuters/723Y42DH5JMXHCZ4WH77LPQGJU.png)

Column Malaysia Deals Fresh Blow To Global Copper Scrap Trade Andy Home Reuters

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Malaysia Tax Revenue 1980 2022 Ceic Data

Malaysia Market Profile Hktdc Research

Department Of Statistics Malaysia Official Portal

Malaysia Natural Gas Imports 1975 2022 Ceic Data

21 Sept 2020 Forced Labor Infographic Crude